Tangible Personal Property Tax California . What is business personal property? Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Examples of tangible personal property include. Sections 106, 110, 401, 401.5 and 601, revenue and. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. Sale of equipment agreed by the parties to be personal property. Retail sales of tangible personal property in california are generally subject to sales tax. —equipment was tangible personal property where the parties.

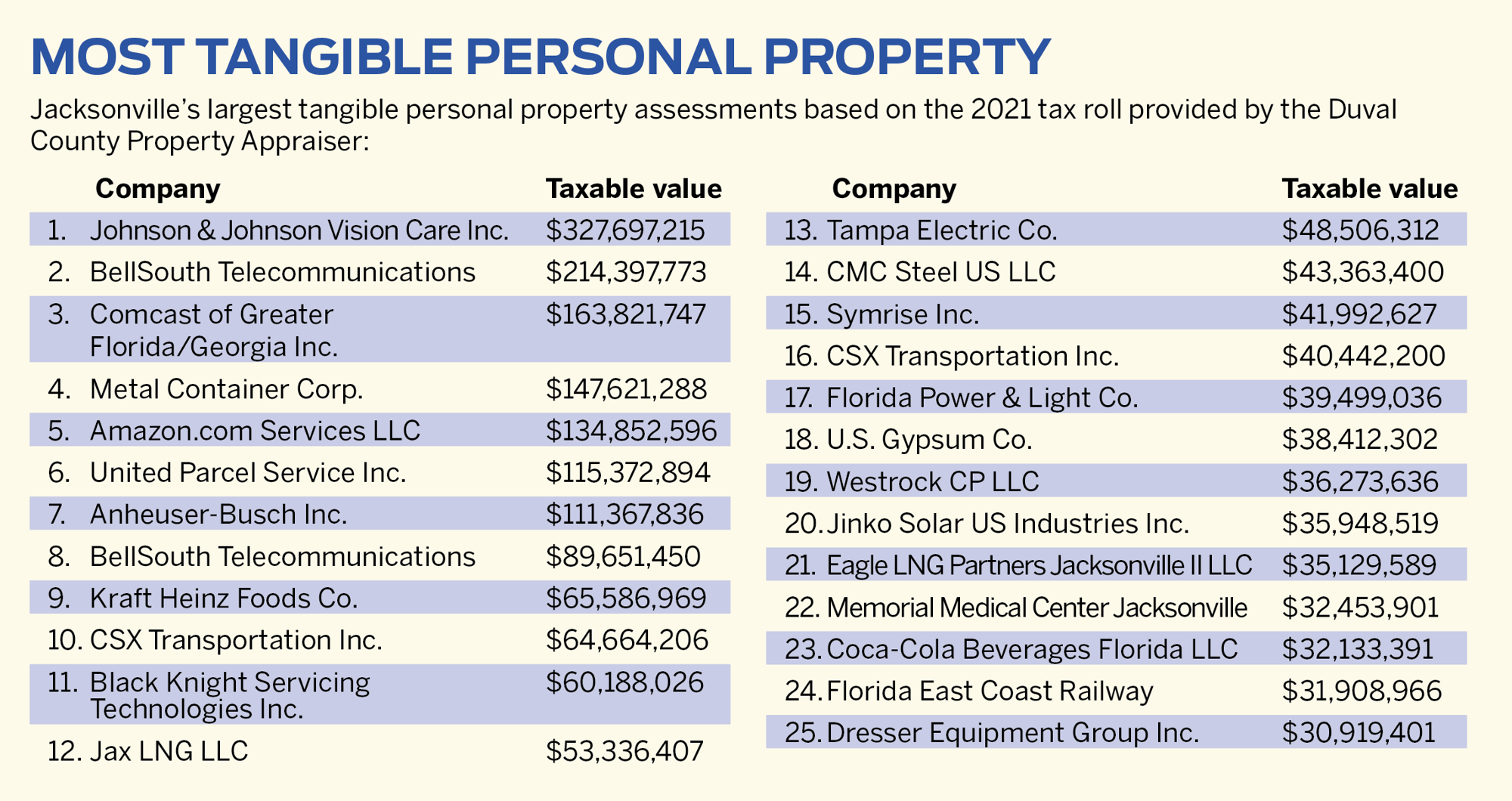

from www.jaxdailyrecord.com

Sections 106, 110, 401, 401.5 and 601, revenue and. Sale of equipment agreed by the parties to be personal property. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally. Retail sales of tangible personal property in california are generally subject to sales tax. —equipment was tangible personal property where the parties. Examples of tangible personal property include. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. What is business personal property?

Data Trends Tangible personal property tax A cost of doing business

Tangible Personal Property Tax California These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Sale of equipment agreed by the parties to be personal property. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Retail sales of tangible personal property in california are generally subject to sales tax. Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. What is business personal property? —equipment was tangible personal property where the parties. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally. Examples of tangible personal property include. Sections 106, 110, 401, 401.5 and 601, revenue and.

From www.youtube.com

What is Tangible Personal Property? Sales Tax Shorts YouTube Tangible Personal Property Tax California Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. —equipment was tangible personal property where the parties. Sale of equipment agreed by the parties to be personal property. Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Tangible personal property leased, rented,. Tangible Personal Property Tax California.

From www.bmcestateplanning.com

Tangible Personal Property What Is It and the Role It Plays in Your Tangible Personal Property Tax California Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally. Sections 106, 110, 401, 401.5 and 601, revenue and. What is business personal property? Examples of tangible personal property include. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade. Tangible Personal Property Tax California.

From www.formsbank.com

Tangible Personal Property Rental Tax Return Form printable pdf download Tangible Personal Property Tax California Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Retail sales of tangible personal property in california are generally subject to sales tax. —equipment was tangible personal property where the parties. These personal and business taxes are assessed on certain tangible personal property items, depending on where you. Tangible Personal Property Tax California.

From www.formsbank.com

Fillable Form Dr405 Tangible Personal Property Tax Return printable Tangible Personal Property Tax California —equipment was tangible personal property where the parties. Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Retail sales of tangible personal property in california are generally subject. Tangible Personal Property Tax California.

From wshlawyers.com

What is a Tangible Personal Property List and What Are The Benefits Tangible Personal Property Tax California Sale of equipment agreed by the parties to be personal property. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. Retail sales of tangible personal property in california. Tangible Personal Property Tax California.

From madeleinewruthy.pages.dev

Property Tax California Due Date 2024 Gussy Jennine Tangible Personal Property Tax California Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. Sections 106, 110, 401, 401.5 and 601, revenue and. Retail sales of tangible personal property in california are generally subject to sales tax. What. Tangible Personal Property Tax California.

From www.hendrycountytc.com

Tangible Personal Property Taxes Hendry County Tax Collector Tangible Personal Property Tax California Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally. Retail sales of tangible personal property in california are generally subject to sales. Tangible Personal Property Tax California.

From www.youtube.com

Tax MACRS for Tangible Personal Property, 2 of 3 YouTube Tangible Personal Property Tax California Examples of tangible personal property include. Retail sales of tangible personal property in california are generally subject to sales tax. Sections 106, 110, 401, 401.5 and 601, revenue and. What is business personal property? Sale of equipment agreed by the parties to be personal property. These personal and business taxes are assessed on certain tangible personal property items, depending on. Tangible Personal Property Tax California.

From www.formsbank.com

Fillable Tangible Personal Property Tax Return City Of St. Louis Tangible Personal Property Tax California These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Retail sales of tangible personal property in california are generally subject to sales tax. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally.. Tangible Personal Property Tax California.

From www.vrogue.co

How To Read Your Property Tax Bill Property Walls vrogue.co Tangible Personal Property Tax California Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. What is business personal property? These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade. Tangible Personal Property Tax California.

From www.jaxdailyrecord.com

Data Trends Tangible personal property tax A cost of doing business Tangible Personal Property Tax California These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Examples of tangible personal property include. Sections 106, 110, 401, 401.5 and 601, revenue and. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. —equipment was tangible personal property where the parties. Tangible personal. Tangible Personal Property Tax California.

From www.formsbank.com

Form Dr405 Tangible Personal Property Tax Return 2001 printable pdf Tangible Personal Property Tax California Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Retail sales of tangible personal property in california are generally subject to sales tax. Examples of tangible personal property include. Tangible personal property leased,. Tangible Personal Property Tax California.

From www.youtube.com

Understanding Tangible Personal Property Taxes YouTube Tangible Personal Property Tax California Sale of equipment agreed by the parties to be personal property. Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Examples of tangible personal property include. —equipment was tangible personal property where the parties. Tangible personal property leased, rented, or loaned for a period of six months or. Tangible Personal Property Tax California.

From www.dochub.com

Tangible personal property schedule Fill out & sign online DocHub Tangible Personal Property Tax California These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. Sale of equipment agreed by the parties to be personal property. Sections 106, 110, 401, 401.5 and 601, revenue and. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at. Tangible Personal Property Tax California.

From www.youtube.com

2021 California Property Tax Updates and Developments. Prop 13, Prop 19 Tangible Personal Property Tax California Tangible personal property owned, claimed, possessed, or controlled in the conduct of a profession, trade, or business may be subject to. Sale of equipment agreed by the parties to be personal property. What is business personal property? These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. —equipment was tangible. Tangible Personal Property Tax California.

From www.hechtgroup.com

Hecht Group Who Pays For Tangible Personal Property Taxes? Tangible Personal Property Tax California These personal and business taxes are assessed on certain tangible personal property items, depending on where you live and what. What is business personal property? —equipment was tangible personal property where the parties. Retail sales of tangible personal property in california are generally subject to sales tax. Sale of equipment agreed by the parties to be personal property. Examples of. Tangible Personal Property Tax California.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Tangible Personal Property Tax California —equipment was tangible personal property where the parties. Sections 106, 110, 401, 401.5 and 601, revenue and. Examples of tangible personal property include. Sale of equipment agreed by the parties to be personal property. Tangible personal property leased, rented, or loaned for a period of six months or less, having a tax situs at the place where the lessor normally.. Tangible Personal Property Tax California.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Tangible Personal Property Tax California Examples of tangible personal property include. Tangible property owned, claimed, possessed or controlled in the conduct of a profession, trade or. What is business personal property? —equipment was tangible personal property where the parties. Sections 106, 110, 401, 401.5 and 601, revenue and. These personal and business taxes are assessed on certain tangible personal property items, depending on where you. Tangible Personal Property Tax California.